Wealth Management Can Be Fun For Anyone

Wiki Article

All about Wealth Management

Table of ContentsWealth Management - Truths3 Simple Techniques For Wealth ManagementFascination About Wealth Management7 Simple Techniques For Wealth ManagementA Biased View of Wealth Management

The non-financial aspects include way of life options such as just how to hang out in retired life, where to live, and also when to quit working completely, among other things. A holistic approach to retirement preparation considers all these areas. The emphasis that a person places on retired life preparation adjustments at various phases of life.

Others state most retirees aren't conserving anywhere near adequate to fulfill those standards and must readjust their lifestyle to reside on what they have. While the amount of cash you'll want to have in your nest egg is very important, it's additionally an excellent idea to consider all of your expenses.

The Best Guide To Wealth Management

As well as since you'll have extra spare time on your hands, you might additionally intend to consider the cost of enjoyment and traveling. While it may be tough to come up with concrete numbers, make certain to come up with a practical quote so there are not a surprises later.

No matter where you remain in life, there are numerous essential steps that use to almost everyone throughout their retirement planning. The complying with are a few of the most common: Develop a plan. This includes deciding when you wish to start conserving, when you wish to retire, and also how much you wish to save for your utmost objective.

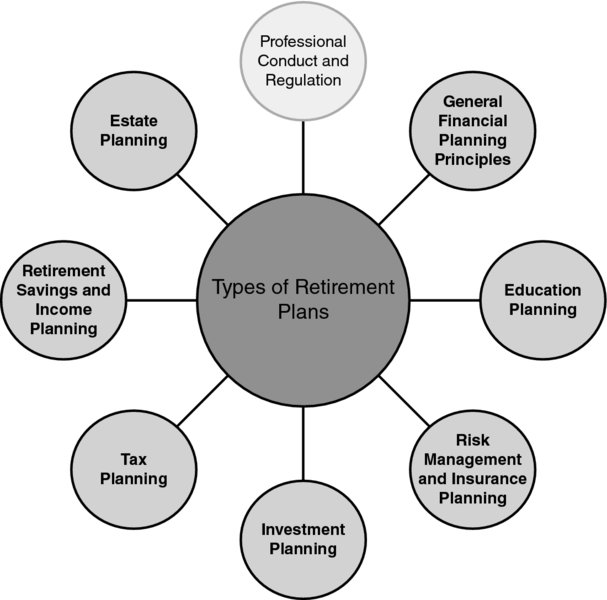

Examine on your financial investments from time to time as well as make periodic modifications. Retirement accounts come in numerous forms and sizes.

You can and need to add even more than the quantity that will earn the employer match. Actually, some professionals recommend upward of 10%. For the 2023 tax year, individuals under age 50 can contribute up to $22,500 of their incomes to a 401( k) or 403( b) (up from $20,500 for 2022), a few of which might be in addition matched by an employer. wealth management.

10 Easy Facts About Wealth Management Described

This indicates that the money you save is deducted from your income prior to your tax obligations are taken out. It decreases your taxed revenue as well as, as a result, your tax obligation responsibility.When it comes time to take distributions from the account, you are subject to your standard tax rate at that time. Keep in mind, though, that the cash expands on a tax-deferred basis.

Roth IRAs have some constraints. The payment limitation for either individual retirement account (Roth or traditional) is $6,500 a year, or $7,500 visit here if you are over age 50. Still, a Roth has some income restrictions: A solitary filer can add the sum total only if they make $129,000 or less annually, since the 2022 tax year, and also $138,000 in 2023.

Top Guidelines Of Wealth Management

It functions the same method a 401( k) does, allowing workers to save cash immediately through pay-roll reductions with the option of a company match. This amount is covered at 3% of an employee's annual income.Catch-up payments of $3,500 allow employees 50 or older visit their website to bump that limit as much as $19,000. When you established up a retired life account, the question ends up being just how to route the funds. For those frightened by the securities market, think about buying an index fund that calls for little upkeep, as it simply mirrors a securities market index like the Requirement & Poor's 500.

Below are some standards for effective retired life preparation at different stages of your life. Those embarking on adult life may not have a great deal of money complimentary to spend, however they do have time to allow financial investments fully grown, which is an essential and important piece of retirement savings. This is because of the principle of compounding.

Even if you can only place apart $50 a month, it will certainly be worth three times a lot more if you spend it at age 25 than if you wait to start investing till age 45, thanks to the delights of intensifying. You may be able to spend more money in the future, yet you'll never ever be able to make up for any kind of lost time.

Wealth Management Can Be Fun For Everyone

However, it's critical to proceed saving at this stage of retirement preparation. The combination of gaining more cash and also the time you still have to invest and make interest makes these years several of the very best for hostile cost savings. Individuals at this stage of retirement planning need to remain to take advantage of any kind of 401( k) matching programs that their employers supply.Report this wiki page